Working Until You Stop or Drop

Not that long ago, the average life expectancy was considerably shorter than it is today. People worked until they died or became too ill to continue working (at which point they’d be cared for by a spouse and/or children), never experiencing the “golden years” of retirement that we’ve come to expect in modernity.

Yet, even with longer lives and well known programs such as Social Security, many people are reaching today’s standard retirement age just to find that they will need to keep working in order to pay their bills.

While some folks derive an extreme sense of purpose and self-worth from their workplace efforts, I know that I don’t want to work until I’m dead or too worn down to properly enjoy life. I am happy to put in the effort that my job requires, and it feels good to contribute to a project’s success, but I put great value on my personal time outside of the workplace.

The idea of not being reliant on the income of a full-time job (i.e. working for a living) is immensely appealing to me.

So how will I make that happen?

The Snowball Effect

Let’s start with the concept of compound interest.

In a nutshell, money that is invested into an account that gains interest over time benefits from being left to grow even more. First, the initial principle (the money you put in) earns interest. Then that interest is added to the principle, and it begins to earn interest, as well!

This “compound” effect of growth is like a snowball rolling down a hill, growing larger as it descends and picks up more snow.

The important takeaway? The sooner you move to invest money, the more time it will have to grow and snowball before you consider retirement. By setting aside money now, you are paying your future self so much more.

The Pain of Losing a Leg

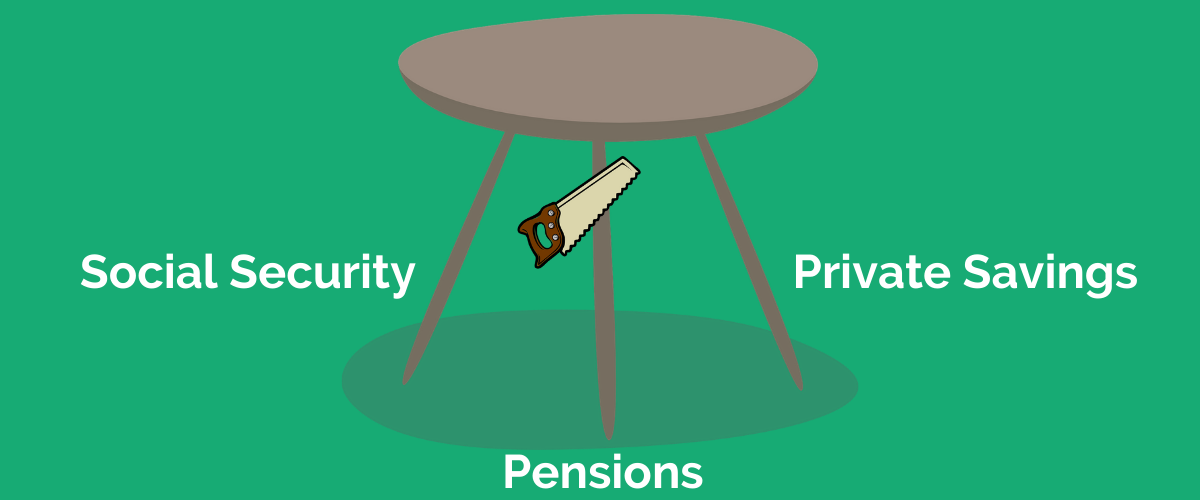

There was a time where retirement planning was viewed as a three-legged stool, with the supports being:

- Social Security

- Pensions

- Private Savings

As capitalism has rocketed our economy forward, the need for maximizing profit margins has caused a shift in where the onus of retirement planning is placed. Where once the company invested in the worker’s future through workplace pensions, the worker is now expected to fend for themselves (at a theoretically higher salary, though I doubt this is always the case) in the form of workplace or private retirement plans.

There are still some examples of pension programs out there, particularly with public municipalities and governments, but by and large the days of pension programs are behind us. Knowing that the average worker now has just Social Security and their own private savings to count on in retirement, it is very important that private savings are made beefy enough to support the retirement stool in lieu of the pension leg.

Investing for Retirement

How do we best utilize compound interest to provide ourselves a safe and secure retirement income? Through various forms of investing!

There are multiple places where you can invest money, but one of the best places to stash your investments is in a designated retirement account.

Why is this the case?

Retirement accounts, whether they are offered through an employer (401(k), 403(b), 457(b), etc.) or a private investment bank (IRA through Vanguard, Fidelity, Schwab, etc.), are considered “tax advantaged” accounts. These accounts have some sort of protected status from regular income taxation, in the form of either being taxed now but not later (Roth) or taxed later but not now (Traditional).

Uncle Sam will ultimately get some piece of the pie, but you have some control on when and how much the federal government gets out of the deal.

Being a middle-income earner, I see a lot of value in Roth investing. When filing my taxes at the year’s end, I am able to keep my taxable income within the 12% bracket due to my modest earnings and my available deductions and credits. Since I can afford to pay the taxes on my full earnings, and since I consider a 12% marginal tax rate quite palatable when compared to 22%, I am comfortable having a percentage of my paycheck automatically deducted and contributed to a Roth workplace retirement account.

While this approach does not give me a tax break from my retirement contributions (since Roth contributions are post-tax, or removed from your earnings after taxes have already been accounted for), the Roth account grows with the aid of compound interest and DOES NOT require you to pay income tax on withdrawals once you reach eligible retirement age.

Years of tax-free compound growth with no tax liability on the withdrawals, and the trade-off is paying a 12% marginal income tax today? Sounds like a winning retirement situation!

Making Adjustments

In the next few years, I expect my salary to rise a modest amount. By my calculations, these incremental raises will start to change the math of the above outlined situation.

Once I am no longer able to keep my taxable income within the 12% tax bracket through other deductions and credits, I plan to begin splitting my retirement account contributions between the existing Roth account and a new Traditional account.

Why do this?

Well, Traditional account investments are considered pre-tax contributions, meaning that any income you divert towards a Traditional account is not considered for the year’s taxable liability. By reducing my taxable salary by an amount equal to my Traditional account contributions, I will continue to be able to keep myself within the 12% marginal tax bracket.

As the years go by, I will continuously tweak the percentage of my investments going to either Roth or Traditional based around my earnings and the tax brackets of the year to best minimize my taxes.

PS: Whatever type of retirement account(s) you choose to invest in, make sure to take advantage of any employer match you have access to!

Looking to the Future

Whether you choose to invest Roth, Traditional or some mix of the two is entirely dependent on your current situation, as well as your outlook on the future of our nation’s tax brackets.

Many high income earners attempt to maximize their Traditional contributions, as this can greatly reduce the amount of taxable salary they have for the higher marginal tax brackets that they fall into during their earning years.

Others simply believe it best to minimize your tax liability in the now, as there is no way to be sure what the tax brackets will look like in the distant future. The advantages of a tax-free Roth account will feel lesser if the marginal tax rates are lower in the future – though I’d argue the opposite is just as likely, and that those with Roth holdings could feel even better about their decision if the the tax brackets are higher in the future than they are now.

I suppose the real takeaway should be that diversification is key, a lesson that rings true in many aspects of investing.

If you have taxable earnings from Social Security and/or a pension, and have both Traditional and Roth retirement accounts available to you, you will have a lot of flexibility in choosing where to withdraw your money. This will allow you to best optimize your taxes and to enjoy your golden years with financial peace of mind.