As the name of this website implies, I have built a number of frugal practices into my daily life. Some money-saving strategies make a huge difference, such as living in a modest home vs. the most expensive one you can afford. Other times, we make choices that don’t seem so important in the moment. Here are just a few of the ways that I save a little bit of money every day, which adds up to a lot saved over time!

1. I make use of my library membership.

If you like to read books and/or listen to audiobooks, a free library membership could be saving you a considerable amount of money.

In addition to physical books and audiobook CDs, my library offers free access to both Libby and Hoopla, which are free apps linked to my library card. I can use Libby to borrow 3 audio/ebooks and place 5 holds on other audio/ebooks at a time. I’m also permitted to instantly borrow up to 5 audiobooks, ebooks, comics, music, movies, or TV shows per month with Hoopla.

It is worth mentioning that many libraries offer other things for free, too! This varies from library to library, but often includes:

- museum passes

- language learning subscriptions

- household tools

- children’s toys

- computer/internet access (and printing for a small fee)

- social activities

- event space

2. I don't use many bath/body products.

I used to have approximately 1 million bottles, tubes, and bars of face wash, toner, moisturizer, body wash, body soap, hand soap, and body lotion. Somewhere along the line I decided to use up what I had and then focus on simpler, multi-use products with higher quality ingredients.

I have been buying the 32 oz bottles of Dr. Bronner’s Peppermint Pure-Castile Liquid Soap (or the store brand version!) for the past few years and using it as hand soap and body wash. The soap is very concentrated, so I dilute it with a ratio of 1 part soap and 3-5 parts water in a dispenser with a foaming pump. Because the liquid is so concentrated, I seem to only go through one or two of the 32 oz bottles per year! According to the Dr. Bronner’s website, the uses for castile soap are nearly endless: face, body, hair, teeth (yuck?), dishes, laundry, all-purpose cleaning, dog washing, plant/ant spray, and the list goes on. I cannot vouch for all of these!

For body lotion, I look for larger-than-average bottles, as buying in bulk tends to save a good deal of money. The 32 oz Alba Botanica Very Emollient Herbal Healing Lotion is affordable and lasts me for months!

For my face, I like Thayers Rose Petal Facial Toner, Good Molecules Hyaluronic Acid Serum, and CeraVe Hydrating Mineral Sunscreen with Sheer Tint.

3. I don’t do much single-use laundry.

Unless I get my clothing sweaty or dirty I usually wear each item more than once before washing. This excludes socks, underwear, and most athletic clothes! I also typically use my bath towel several times between washes.

I’m also just going to throw it out there that I haven’t used dryer sheets in years and I’m not a walking electrocution machine with clingy clothing. You probably wouldn’t be, either! I recently got reusable, wool drier balls because they are supposed to reduce drying time in addition to preventing static.

4. I plan the week’s meals in advance.

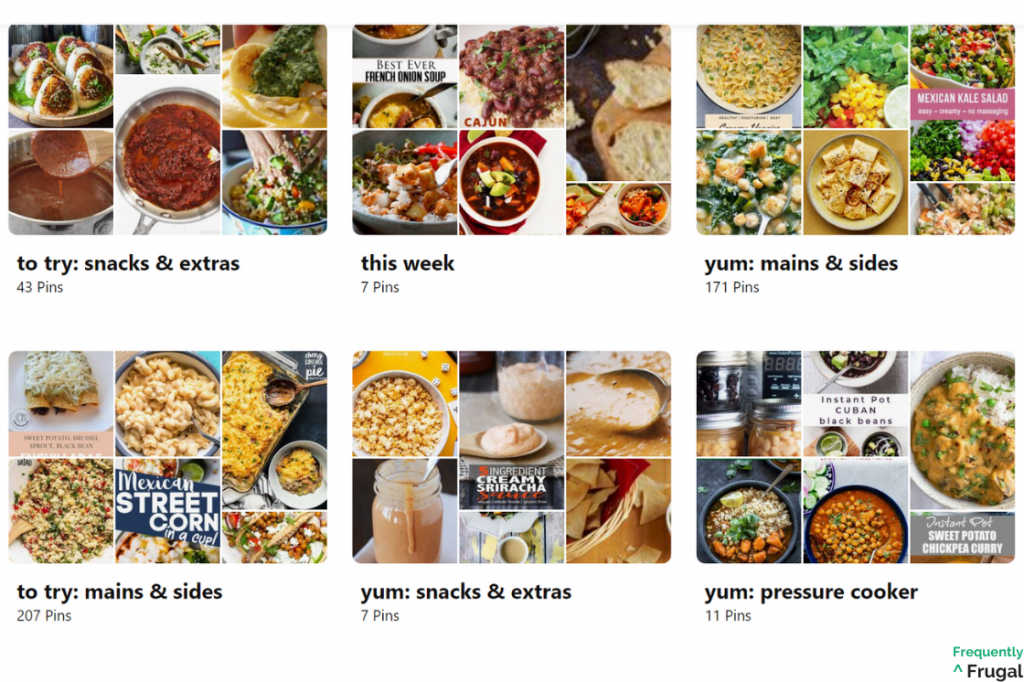

I use Pinterest to create a menu for the week, use it to build a shopping list, and then only buy what is needed for the meals I have planned (plus staples like fruit and milk). We do buy things like sweets and beer/wine with some regularity, but making the shopping plan is still very effective at keeping our grocery bills extremely low.

Click here to learn more about my meal-planning strategy.

5. I buy the store brand.

The store brand is almost always less expensive and just as tasty (for food) or effective (for household products) when compared to the name brands. I buy store brand peanut butter, pasta, beans, crackers, paper towels, toilet paper, tissues… and more!

6. I rarely buy meat.

During my AmeriCorps days, I became interested in having a more plant-based diet in order to save money and eat healthier. I don’t follow a strict vegan diet – I still periodically buy foods like cheese, Greek yogurt, or bacon – but they key is that I almost never plan a meal around meat.

Instead of cooking chicken breasts/steak/pork chops with vegetables on the side, the vegetables are the center of attention in our house. Black beans, chickpeas, or tofu keep the meals hearty, and the flavor comes from spices, the roasted or pan fried vegetables, and often tomato sauce and/or coconut milk. I make a lot of curries, which are delicious and can cost as little as $1-2 per person per meal!

7. I cook at least enough food for dinner and the next day's lunch.

For the first several months after graduating from college, I cooked dinner for Hans and myself, we ate it all, and then we took sandwiches and snack food for our lunches. Our grocery costs shrank considerably when I decided to start buying enough ingredients to bulk-cook meals, instead.

This set of Utopia Kitchen glass food storage containers of various sizes will be useful if you aren’t currently in the habit of meal prepping or saving leftovers but want to give it a try.

8. I drink lots of water.

I always have a water bottle with me. Water is typically available for free, and if you feel thirsty, water is what your body wants! If I’m consuming drinks like coffee, seltzer, and alcohol, it’s an active choice, not my default. It’s healthier this way, and it means that I’m not thoughtlessly spending money on beverages.

Drinking lots of water throughout the day also leaves me feeling more awake/focused, less snacky, and better able to perform physically if I’m going for a hike, ski, etc. – all by avoiding the mild dehydration that many people constantly live with.

Here are a few water bottle suggestions depending on what you are looking for:

- Plastic: Nalgene Tritan Wide Mouth BPA-Free Water Bottle or Polar Bottle Sport Insulated Water Bottle (insulated)

- Glass: Contigo Purity Glass Water Bottle, 20 oz

- Stainless Steel: MIRA 25 Oz Stainless Steel Vacuum Insulated Water Bottle

- Higher Quality: 24 oz Hydro Flask Standard Mouth Water Bottle (I have & love the 24 oz Spearmint version) or 40 oz Hydro Flask Wide Mouth Water Bottle

Disclaimer:

Okay, so these next two options are slightly “bigger” choices than simply borrowing a book vs. buying it. But you probably don’t think twice about your monthly cell phone or car payment, and I’m going to explain why you might want to. It’s time to level up!

9. I drive a reliable, old car.

My grandmother left me her 2004 Toyota Camry when I was 16 (in 2010), which only had about 37k miles on it at the time. It is not sleek. It does not have any of the latest technology; it has a cassette player, in fact. But it has been an awesome car and it is still going strong.

Once I was finished with my AmeriCorps days, I thought for a time that I would upgrade the car as soon as I saved up some money. But once I began paying off my student loans and then contributing to my retirement and investment accounts, I quickly decided that a shiny new car is not high on my priority list.

With regular maintenance, my Camry is likely to remain dependable for at least another handful of years. I will inevitably have to pay for a few more replacement parts, but the insurance and registration fees are low, and I don’t have a monthly car payment.

The ChooseFI podcast had an early episode devoted to The True Cost of Car Ownership, which is pretty eye-opening. The show notes also link to relevant resources to further explore this topic.

10. I re-evaluated my cell phone plan.

While it’s easy to fall into the trappings of large data plans and cell phone payment plans offered by the big cell phone companies, a great way to save money on a monthly basis is to pursue non-carrier specific phones with third-party providers.

While not purchasing a $1,000 flagship cell phone is an obvious way to save some coin, many people don’t know about the companies that lease the use of cell phone towers from the Verizons and T-Mobiles of the world. Since they don’t need to own and maintain the infrastructure, they are generally able to more offer competitive rates and flexible plans.

A few great examples are:

Mint in particular offers some pretty incredible savings if you bulk-buy data plans. At the time of writing this, all of their plans offer unlimited talk & text and you can purchase 3/6/12 months of a 3/8/12 gigabyte-per-month data plan and see some significant savings compared to the leading service providers.

Many people enjoy the always-on nature of unlimited data plans, but this comes at a huge cost. I encourage you to consider settling for less than unlimited – especially if you’re largely in Wi-Fi range and not constantly streaming videos or music.

Unfortunately for me, this frugal find only benefits Hans for now. Similarly to how I considered buying a fancy new car (see #9), I also considered buying a fancy new phone… and acted on it. I bought a Google Pixel 3 at a discount when it was still pretty new, but that discount tied me to a 2-year Verizon contract. Hans, however, was able to take my suggestion and switch to Mint Mobile.

While I don’t think that any of these strategies to save money are particularly earth shattering, they all work really well for me. I hope that anything you try proves to be successful for you, too!